Investor Relations

Basic policy on the profit of distribution

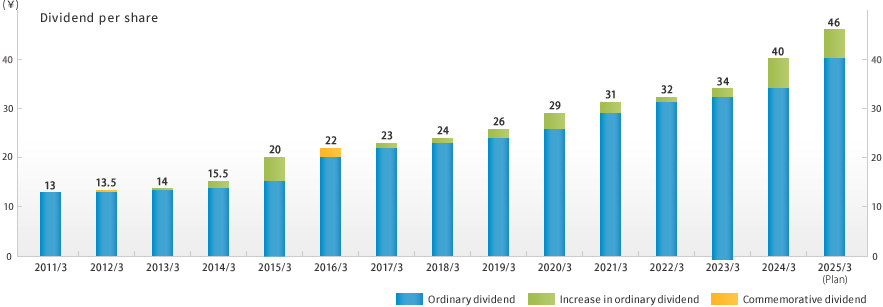

Kondotec regards the return of profits to shareholders as one of its important policies. We work to improve earnings power and increase capital efficiency by making strategic investments through M&A deals and actively expanding investment in businesses expected to drive future growth. The dividend policy targets consolidated DOE of at least 4.0% and continuous increases in dividends while fully taking into account the consolidated payout ratio.

DOE is the ratio of dividends returned from net assets. By adopting DOE as an index, it enables us to continuously raise dividends despite temporary fluctuations in profits. We also aim for ROE of 10% or higher, which indicates capital efficiency. This means that by earning profits above a certain level each fiscal year, the net assets that form the basis for determining the dividend will increase, and as a result, we will be able to continuously increase dividends.

Transition of dividend