Investor Relations

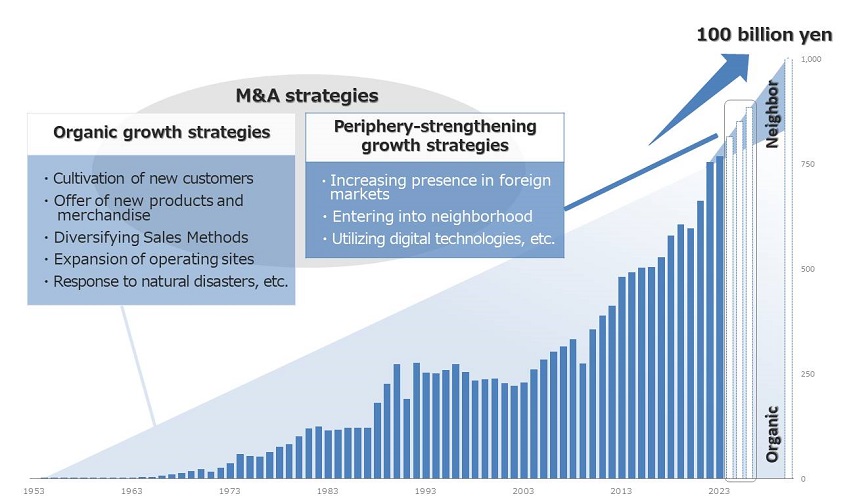

KONDOTEC has two sides, as a wholesale company and a manufacturer. Fusion of these two has been generating not simply two, as a result of one plus one, but infinite expansion. The Company divides the growth strategy into two; organic growth strategies and periphery-strengthening growth strategies. Organic growth strategies are the business strategies for existing businesses, based on which KONDOTEC has established the earnings base to date.

On the other hand, periphery-strengthening growth strategies are the initiative to strengthen those other than the existing businesses, which is advocated as strategies for a possible new earnings driver aiming for a further leap going forward. With these as pillars, we will strive to exceed net sales of 100 billion yen during 2020s. We will continue to expand businesses to achieve sustainable growth.

Existing business strategies (organic growth strategies)

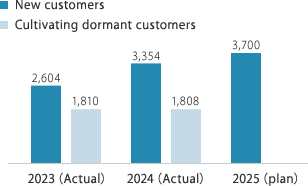

Cultivation of new customers

Cultivation of new customers and dormant customers

We achieve a monthly average of one new customer per sales representative.

In addition, we exploit a yearly average of 10 dormant customers per sales representative.

These activities from the source for 20,000 sales customers.

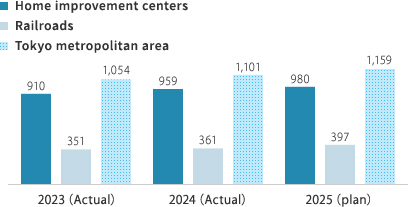

Cultivation of distribution routes

We are working to expand into markets with growing demand, such as home improvement centers and railroad companies, in addition to the existing sales routes.

We also strive to expand our business by developing distribution routes to set up an E-commerce Group, making approaches to new customer through online sales.

Further, we have in place a sales force dedicated to the Tokyo metropolitan area

to handle bulk purchasing from large trading companies and headquarters of general construction companies from which orders have been increasing in recent years.

Net sales (million yen)

Offer of new products and merchandise

For the purpose of developing new merchandise, joint New Products and Merchandise Committee meeting are held

between the sales division and the manufacturing division periodically to discuss requests from customers and proposals for improvement.

Recently, we developed and launched new products with a focus on weight reduction and labor-saving, including “Alpaca”,

an aluminum square-shaped pipe (manufactured by KURIYAMA ALUMINUM) in 2022 and “Hi Ten Conbrace” (manufactured by KONDOTEC) in 2023.

We will continue to develop and cultivate products and merchandise with even higher added value in order to offer such products and merchandise.

Alpaca

Hi Ten Conbrace

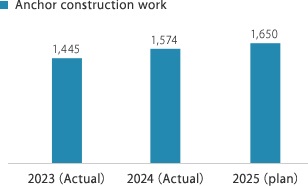

Diversifying sales methods and services

Diversifying services

In addition to selling both in-house products and merchandise via wholesale,

we formulate highly value-added services through, for example, providing anchor bolt installation work.

We have adopted a structure to enable the undertaking of anchor construction by having construction managing engineers and

acquiring a construction business license. By becoming involved in the initial phase of a construction project,

we are able to acquire information on necessary construction materials ahead of others and make use of such information on sales activities.

Furthermore, we operate “Tsurikata,” a lifting equipment inspection site and lifting equipment management service that lets users manage our products via smartphone.

③Adoption of flexible sales methods

We focus on devising sales methods that pinpoint target customers through,

for example, enhancing our catalogs tailored to specific fields (products and merchandise such as lifting equipment and emergency supplies) and customers.

In Scaffolding Construction Segment, we seek to expand customer base through expanding sales formats,

including not only providing scaffolding construction services, but also offering scaffolding material rentals.

Catalog of lifting equipment

Catalog of emergency supplies

Expansion of operating sites

Cultivation of new customers and dormant customers

We strive for expansion of operating sites which maintained a local-community-oriented sales structure in order to respond quickly to customer needs. Recently, we have opened the Hokkaido office of the Company in April 2024. As of end-March 2024, we operate 102 operating sites. We will continue to execute quick deliveries in an effort to realize customer-focused management.

Response to natural disasters

Our products and merchandise support recovery/restoration efforts from disasters and are in demand in the event of abnormal weather conditions,

such as extremely heavy rainfall everywhere.

All operating sites have inventories and maintain a structure across Japan

that enables us to immediately respond to such urgent demand for products and merchandise and carry out our responsibility to supply.

One of merchandise for natural disasters

Left:Tarpaulins

Right:Flexible container bags

Initiatives for enhancing activities in non-existing business (Periphery-strengthening growth strategies)

Increasing presence in foreign markets

Our export business was active prior to the Plaza Accord in 1985

and handled exports worth approximately 2,000 million yen.

However, given the currency crisis in 1997, when Asian currencies slumped, the export business became difficult and we shifted from export to import.

Subsequently, we have opened a dozen OEM plants in China to establish a structure

that is not affected by the yen’s appreciation and resumed exports around 2006. In November 2012,

we established a subsidiary in Thailand to further expand into overseas markets with growth prospects.

Currently, we are moving ahead with activities to expand our business

in ASEAN countries with Thailand as our base location.

We will further strengthen our sales & marketing capabilities by widening our sales network and reinforcing manpower

with a view to increasing the ratio of net sales from our overseas business.

Toward accelerating the growth of the present’s KONDOTEC (Organic) and the future’s KONDOTEC(Periphery-strengthening)

M&A strategies

We view that pursuing corporate acquisitions and capital/business tie-ups is an important strategy to strengthen our business platform. We actively review potential acquisition and tie-up opportunities by analyzing and discussing the growth potential of the relevant business, while taking capital cost into consideration. Going forward, we will continue endeavoring to improve medium to long term corporate value taking into account M&A strategies for growth by periphery-strengthening, such as entering into neighboring industries.

Actual M&A

_2010_ | Acquired shares of Sanwa Denzai Co., Ltd. to make the company a consolidated subsidiary. |

2012 | Established KONDOTEC INTERNATIONAL (THAILAND) CO., LTD. |

2014 | Acquired shares of CHUOH GIKEN Co., Ltd. to make the company a consolidated subsidiary. |

2016 | Acquired the "ALPS-mark iron pulley" manufacturing business from Akinaga Factory Co., Ltd. |

2018 | Concluded a business/capital alliance with N-PAT Co., Ltd., which manufactures and sells construction hardware centered on "Post-construction anchors". |

2019 | Acquired labor-saving and image processing equipment business from Mechatro Engineering Co., Ltd. |

| Acquired shares of HIROSE KOSAN CO., LTD. (currently TECBUILD CO., LTD. ) to make the company a consolidated subsidiary. | |

2020 | Acquired shares of TOKAI STEP CO.,LTD. to make the company a consolidated subsidiary. |

2021 | Acquired shares of FUKOKU, Ltd. to make the company a consolidated subsidiary. |

| Established an intermediate holding company,"Nippon Scaffolding Holdings Co.,Ltd.",by an incorporation-type company split to manage subsidiaries which provide scaffolding construction services. | |

| Acquired shares of KURIYAMA ALUMINUM Co., Ltd. to make the company a consolidated subsidiary. | |

2024 | Acquired shares of UEDA CONSTRUCTION CO., LTD to make the company a consolidated subsidiary. |

Four perspectives in pursuing M&A

1.Neighboring industry

Pursue M&A with companies associated with industries other than the construction industry and promote business expansion

Actual case: Sanwa Denzai Co., Ltd.

KURIYAMA ALUMINUM Co., Ltd.

2.Deepening of business

Pursue M&A with material manufacturers, etc.

Actual case:

CHUOH GIKEN Co., Ltd.

TECBUILD CO., LTD.

(Changed the company name from HIROSE KOSAN CO., LTD.)

TOKAI STEP CO.,LTD.

FUKOKU, Ltd.

UEDA CONSTRUCTION CO., LTD

3.Expansion of business area

Pursue M&A with companies that maintain overseas sites to promote business area expansion

4.Amplifying sales patterns

Pursue M&A with companies that operates different sales patterns from those of KONDOTEC, such as retail, catalog-based selling, and online sales.